- Home

/- Industry News

/- Strategic Review – Global Outlook and Opportunities in Water-Treating Chemicals

Background

- For over 35 years, SAI has monitored the global market for water-treating chemicals and related products, including ion exchange resins, filtration, reverse osmosis, and controls

- From a competitive standpoint, the North American industry has evolved several times starting with the notorious six-pack that almost every chemical company around the world followed and revered as successful companies and attractive investment opportunities

- The six-pack nearly two decades later was narrowed to three major players

- Today, these leading players have been acquired and, in some cases, spun off again

- For many years, the U.S. and European markets were the largest. Today, Asia, driven significantly by demand in China, is the largest market and the fastest growing

- While the market has been viewed as attractive because of growth and margins, there have been ups and downs in the business which created the significant change in ownership of key players, particularly in North America

Global Market

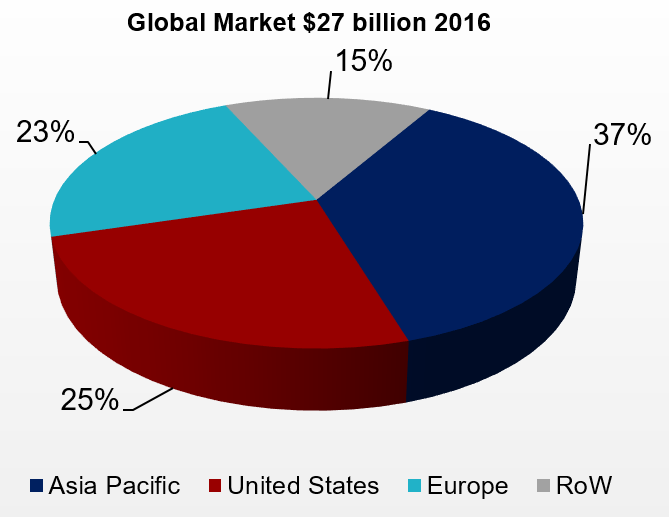

- The global market for water-treating chemicals totaled nearly $27 billion in 2016 and is expected to grow at a rate of about 5.5% a year to 2021

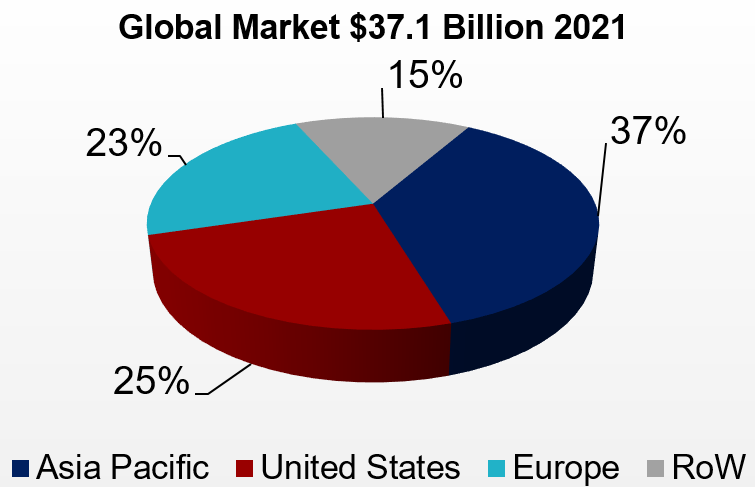

- Today, Asia has become the largest market for water-treating chemicals driven by China and now the growing economy in India with 37% of the total

- The United States accounts for 25% of the business followed by Europe with 23%

Global Market by Chemistry

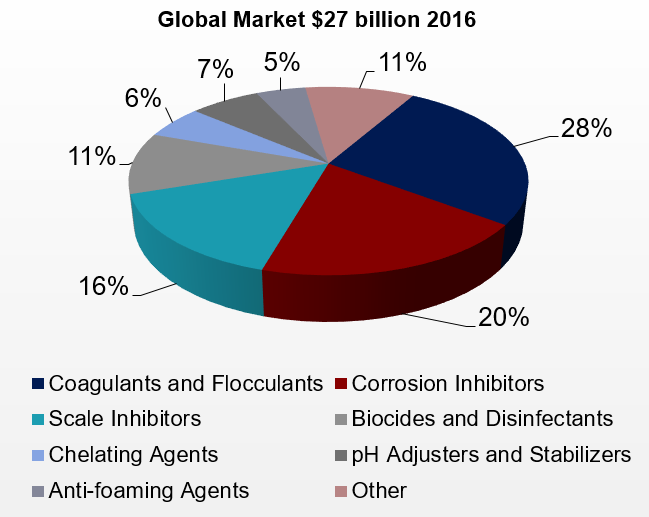

- A variety of different chemicals are used in many applications throughout the world to treat waste and water

- Coagulants and flocculants are the largest category followed by corrosion and scale inhibitors

Global Market by End Use

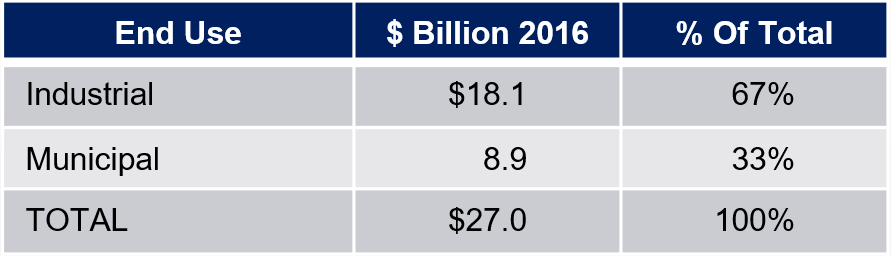

- Water-treating chemicals are used in two major end uses:

- Municipal waste and water treating

- Industrial waste and water treating

- Industrial applications account for over two-thirds of the global market and municipal the remainder, as shown here.

Global Industrial Market

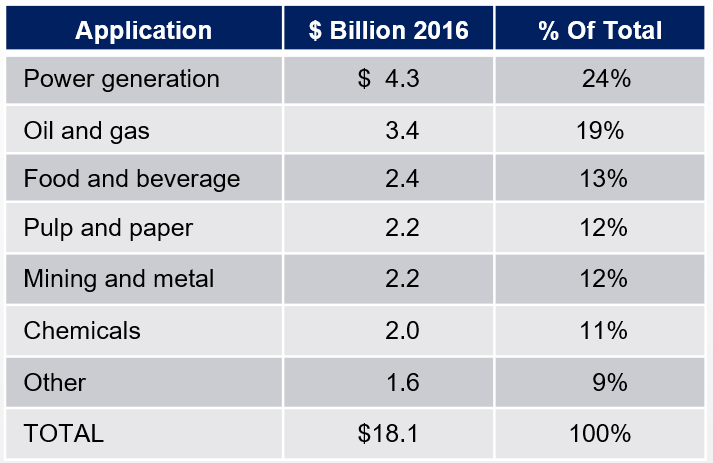

- The industrial business can be broken into key applications, including:

- Chemicals

- Food and beverage

- Mining and metal

- Oil and gas

- Power generation

- Pulp and paper

- Power generation accounts for the largest part of the industrial market followed by oil and gas, as shown here:

Competitive Environment

- The water-treating business globally is led by major U.S. and European water service companies and chemical manufacturers

- Even though these companies are active in the global markets and have the largest market shares, each geographic region of the world has many local competitors servicing the business

- While the multinational corporations have the largest share of the marketplace, no one dominates

- The European and U.S. markets are more concentrated

- The major water service companies include:

- Nalco (owned by Ecolab)

- Solenis (spun off from Ashland)

- GE (soon to be divested)

- Other well-known competitors include:

- Buckman Laboratories

- Dow Chemical (soon to merge with DuPont)

- Air Products’ chemical operation (sold to Evonik)

- AkzoNobel

- BWA Water Additives

- Kemira

- Cortex

- Unlike chemical manufacturers, the water service companies’ offerings are comprehensive selling chemicals, formulated solutions, monitoring devices and services to make sure that the customers’ key equipment is running efficiently

- Cooling towers and boilers, which are critical to the operation of many plants, warehouses, offices, hotels, and other major facilities are a key part of the water service business

- Depending on their needs and philosophy, customers’ requirements vary. Some require complete solutions while others require less support and buy only the chemistry needed to treat their problems

Key Issues Driving Growth

- A number of global issues are driving continued growth in the water-treating industry:

- Increasing demand for water as the world’s population grows

- Pockets of highly-polluted water because of lax environmental regulations

- More stringent regulations in emerging markets like China

- Need for more environmentally-friendly solutions. Chemicals often create a bad image among environmentalists

- While there are many factors driving demand for chemicals, environmental concerns are enhancing the use of non-chemical treatments

- Membranes, UV disinfection and filtration and ultra-filtration technologies are also increasing

Global Future Outlook

- The future outlook for the business is still strong

- Depending on the geography, markets are expected to grow at rates from as little as a couple of percent to over six percent a year to 2021

- Emerging markets are driving global growth

- SAI predicts the global market will grow from $27 billion in 2016 to $37.1 billion in 2021 for an average growth rate of over 5%

- China will remain the largest market in value growing at close to 7% a year

- The United States will remain the second largest market increasing at slightly over 3% annually

Opportunities

- While there have been many changes in ownership of key suppliers, particularly the water service companies, no one company dominates this market in any region of the world

- In emerging markets, the major multinationals are key players, but have even less share of the business than in the Western markets

- Many local players are active and successful

- As a result, there is plenty of room for companies with an interest in this profitable and growing business to access a share of the market by:

- Developing new technologies, products and services

- Acquiring international companies or local players

- In conclusion, SAI’s on-going analysis results in an attractive rating for the water- treating chemical business

SAI

- SAI, a leading international business consulting firm with 375 employees in 13 operations worldwide with staff in North America, Europe, Brazil, India, and China has analyzed the water-treatment chemical and associated businesses, including filtration, reverse osmosis, desalination and other businesses for over 30 years

- As you review this attractive market opportunity, SAI’s staff is available to provide expert knowledge, analysis and advice to help you achieve your objectives

- Click here to contact us today.