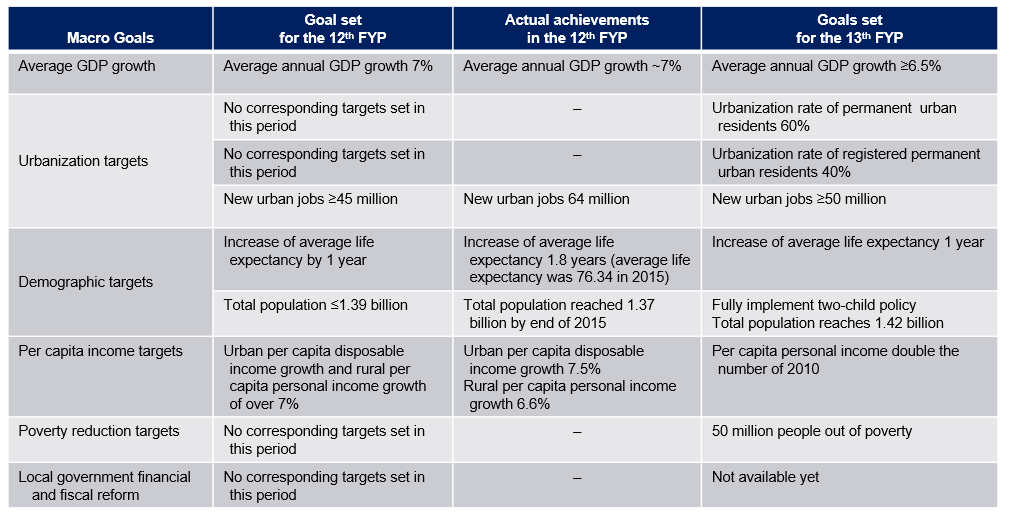

MACRO GOALS OF THE 13th FIVE-YEAR PLAN

China’s New Normal: increasing GDP per capita through the development of emerging strategic sectors, encouraging domestic expenditure and focusing on trade and domestic infrastructure.

The 13th Five-Year Plan (FYP) published in March 2016 is underpinned with the following key tenets:

- GDP per capita to double within 10 years to US$ 7,500 per capita as the government strongly promotes the growth of the middle class and enables more streamlined movement of labor and urbanization

- Restructuring of the economy with emerging strategic sectors to be encouraged and incentivized. Strongly pushing innovation and R&D to promote modernization in manufacturing, agriculture and services

- Over-capacity in certain sectors is to be dealt with, although this measure has already become problematic with labor unrest evidenced

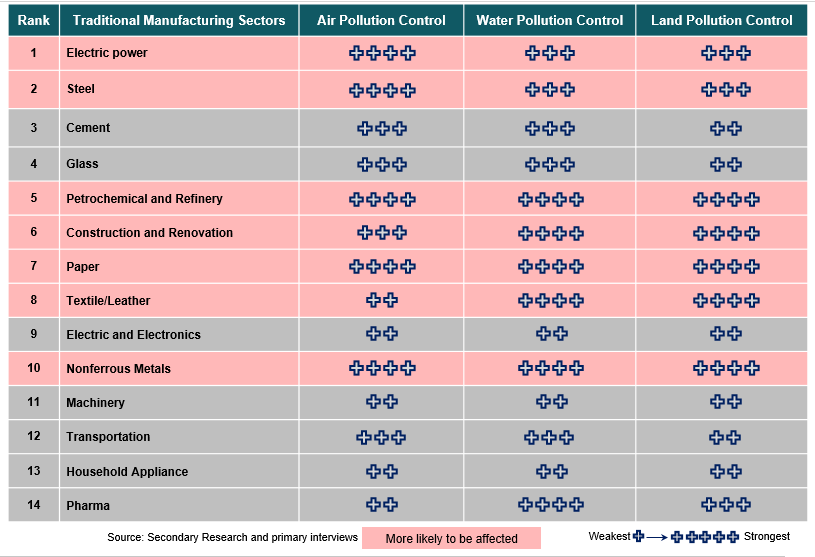

- Protection of the environment with more stringent enforcement of environmental laws to protect air, water and land resources. These measures are also directed towards more efficient utilization of scarce resources

- Continued investment in infrastructure both within China and outside of China through the One Belt One Road (OBOR) concept which is part of China’s strategic intent to secure trade channels globally. Although still in its nascent stages, the OBOR policy is underpinned by strong Asian Bank support and very centralized Chinese Government control. Assets are already being secured offshore in Africa, Australasia, West Asia and South East Asia

This Executive briefing will provide insights within each of the key initiatives of the 13th FYP and will highlight potential opportunities or threats for businesses linked to China.

A key target for the 13th FYP is to double 2010’s GDP per capita by 2020. The FYP, which includes new detailed targets in urbanization, poverty reduction and fiscal reform, indicates a stronger push in socio-economic reforms over previous FYPs.

EMERGING STRATEGIC SECTORS

HIGH-END MANUFACTURING INDUSTRIES

Ten sub-sectors are being prioritized by the government, however, companies need to monitor fresh details of the FYP on an ongoing basis.

Although there have been no specific targets set for most of these strategic industries yet, the 13th Five- Year Plan lists major projects to be implemented in these industries. Businesses will need to continually monitor for fresh details in plans as they are unveiled by the government.

SAI has observed a rapid increase in e-commerce related activities in China within a wide range of sectors beyond traditional e-tailing at the consumer level, but also with the B-to-B space as well.

RAIL

Localization of technologies is both an opportunity and a threat.

- The existing challenges in the Chinese economy are hampering expected economic growth and relative competitiveness. These are driven mainly by:

- High manufacturing costs based on increasing labor and environmental costs

- Limited technologies

- For the FYP, manufacturing will remain a key part of the Chinese economy, however, higher-end manufacturing industries will be incentivized together with upgrading of existing traditional industries

- Robotics is one example. China’s robotics industry is growing rapidly and the country has already become the world’s largest industrial robot market, driven by increasing labor costs as well as the governmental encouragement. In the 13th Five-Year Plan, the government will encourage the further growth of Chinese robotics and focus on support for domestic robot manufacturers

- Governmental measures to be taken will include financial subsidies for research and development, establishment of testing and evaluation centers, and subsidies to demonstrative industries which employ robots, such as tire, ceramic, casting, etc.

- Increasing labor costs have started to drive labor-intensive industries to employ robotic manufacturing, including in the electronic components sector where Foxconn has invested significantly in robotics

- The successful application of robotic manufacturing in the auto industry has attracted other industries to start considering the use of robot technology

- Currently, 150,000 industrial robots are sold annually and there are expected to be 0.8 million industry robots in service by the end of 2020. In the FYP, the target is to develop 5-8 robot industrial clusters and to have greater than 50% of installed robots to be localized by Chinese domestic brands

- The rail sector in China is expected to grow by 10% per annum in 2016–2020. In comparison, the Japanese and Indian sectors will grow with CAGRs of 5% and 8% respectively

- Railway equipment includes electric multiple units (EMUs), locomotives and railway freight cars. The focus in China is on large railway freight cars and bullet trains

- China is disadvantaged by its relatively large gap in locomotive technology versus global competitors, especially in high-power electric locomotives and EMUs

- Through technology acquisitions, China has acquired improved technologies in high-power electric locomotives, diesel locomotives and 200 km/h EMUs. China has managed to achieve localization rates for parts and components of electric locomotives and EMUs of 70% and 75% respectively

- High-speed railway equipment manufacturing is a priority, supported by governmental policy

- Currently, China only has low-level technology in this space

- Government policies are encouraging localization and the introduction of advanced technology. The Chinese government spent 10 billion yuan to buy advanced international technology for state-owned enterprises to upgrade their technology capability

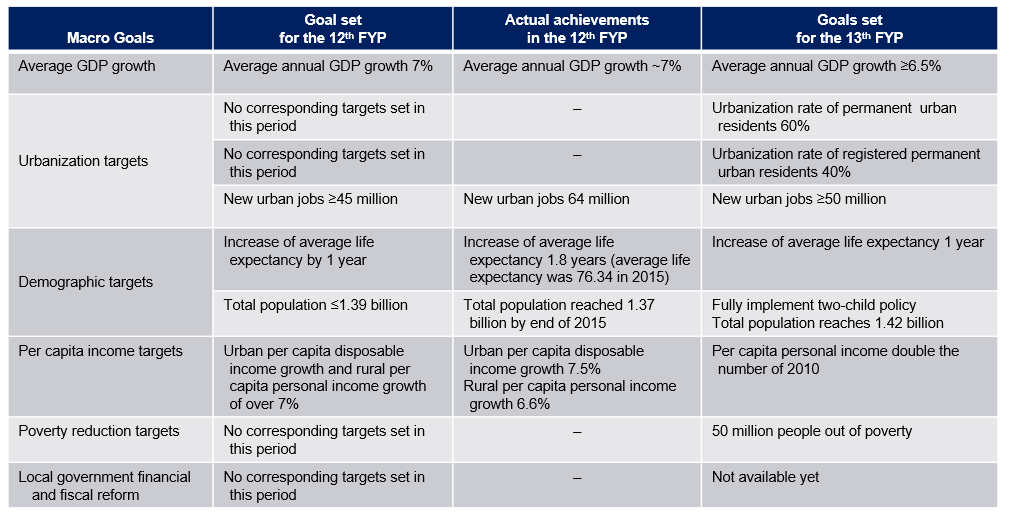

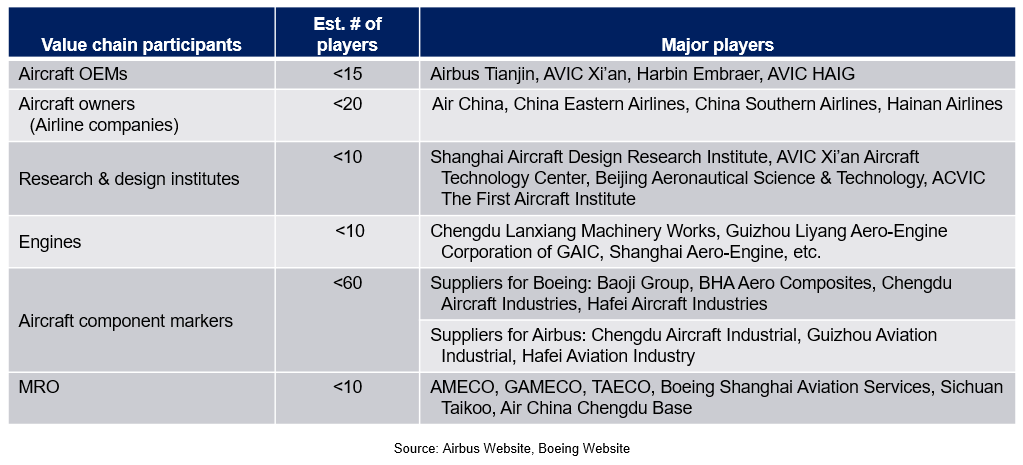

- Globally, the railway equipment market is dominated by only a few large players

- Presently, Germany’s Siemens, France’s Alstom (now GE) and Canada’s Bombardier, share 55% of the total global market (14%, 18% and 23% respectively)

- Bombardier holds the largest market shares of global railway equipment technology and sales

- Alstom remains ahead in EMUs and ordinary single-decker and double-decker electric locomotives

Emergence of CRCC as a global player

- The merger of China’s two largest state-owned rail equipment makers has created an industry behemoth, second only to General Electric in size, that will compete aggressively for projects across Africa, Southeast Asia, and Latin America

- The combined CRCC has revenues of about $36 billion and a workforce of 118,000

- CRRC was created to allow China, home to the world’s largest network of high-speed rail, to become more competitive when it exports rail technology and manufacturing. China, once a major importer of rail technology, wants to be a world leader in high speed rail, with projects that span the globe, focusing especially on emerging markets

- China’s advantage is that it offers a cheaper alternative than its rivals. Chinese rail costs, on average, between $17-21 million per km, compared to non-Chinese companies’ $25-39 million per km, according to World Bank estimates

- China’s global rail ambitions have also run into problems. Its $3.7 billion high speed rail contract in Mexico was cancelled due to internal politics

AEROSPACE

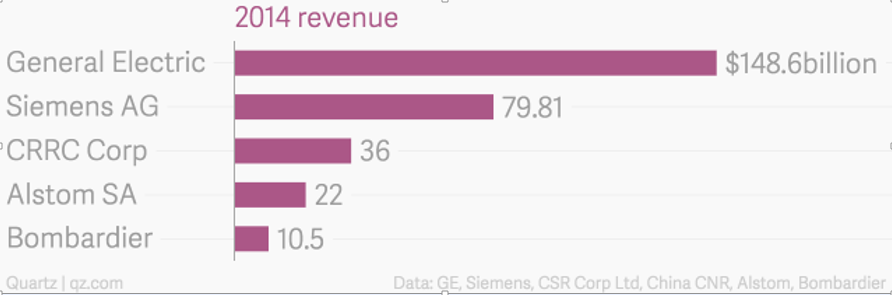

Chinese OEMs and MNCs have set up partnerships in the already fast-growing sector.

- Key segments and players in China’s aerospace industry are as follows:

- Chinese local makers do not have the design capability for commercial aircraft. Therefore, most players are sub-contractors of aircraft OEMs (with design capabilities) such as Airbus and EADS

- However, some major local makers have also started conducting active R&D on both commercial and military aircraft

There are significant opportunities in the components sector within the Chinese aerospace industry. Access to the principal Chinese OEMs is key.

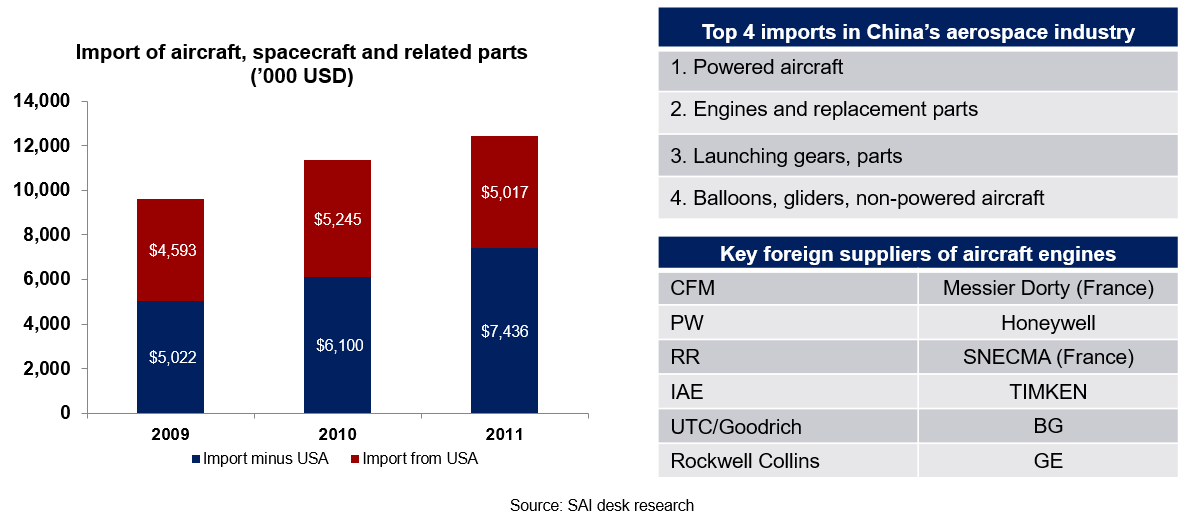

- Despite the efforts of the domestic industry, the import of aircraft, spacecraft and related parts is growing steadily

- The USA used to provide almost half of imports but the total share is diminishing due to substitution from other areas like Europe

- Key foreign suppliers that provide more sophisticated parts and are predominantly multinationals with strong R&D capacity

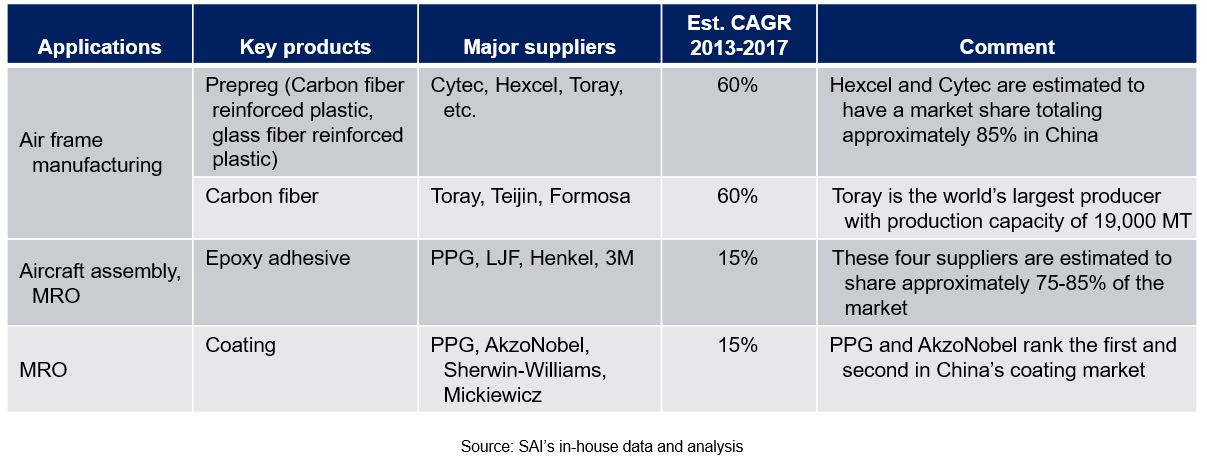

Suppliers of materials are also seeing significant growth opportunities.

- Key applications which will benefit most from a fast growth of aerospace industry in China are:

- Prepreg (CFRP/GFRP): essential material to produce parts and frames

- Epoxy adhesives: used increasingly as a substitute for traditional welding to reduce weight

- Coating: coating consumption is expected to continue to increase at a fast pace, especially in the MRO sectors of China’s aerospace

- >80% of aerospace components are currently imported due to a lack of local producers’ technology and reliability

MEDICAL

Medical supplies and services are a major area of opportunity.

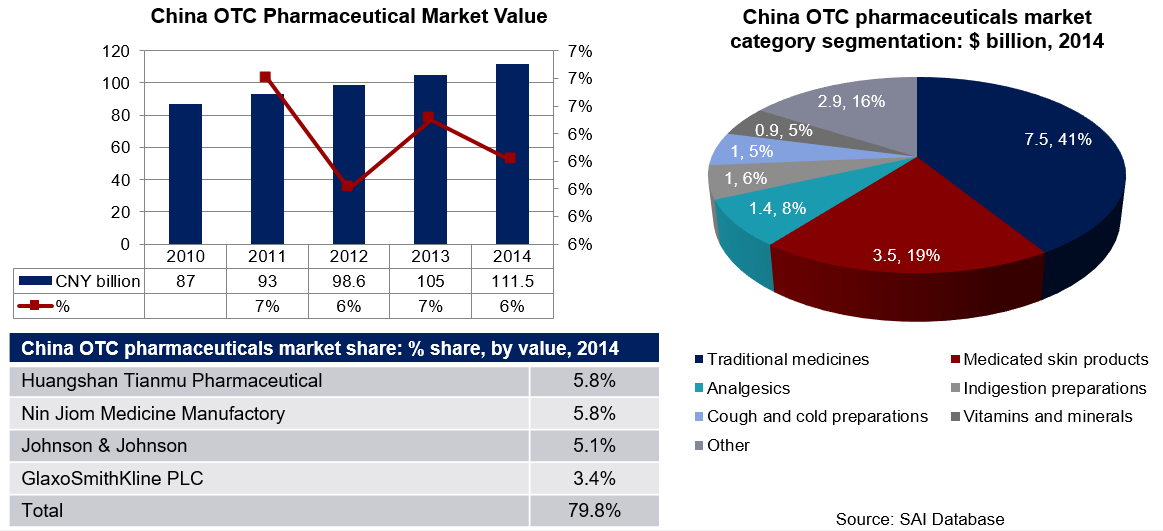

- The Chinese OTC pharmaceuticals market had total revenues of $18.1bn in 2014, representing a compound annual growth rate (CAGR) of 6.4% between 2010 and 2014

- China’s large aging population and inequity in healthcare provision may be behind the strong growth

- Although there is state provision for universal healthcare, the funding systems generally benefit urban populations, with rural dwellers suffering a disparity in quality of treatment. This leads to private clinics thriving, and over the counter drugs being preferred

The Health and Wellness sector is of particularly high interest as the Chinese middle class develops rapidly and domestic expenditure is encouraged.

- According to BCG, China’s growing health and wellness market is poised to reach nearly $70 billion by 2020, based on 11% CAGR in the OTC treatments segment and the vitamins, minerals and supplements (VMS) market

- The survey found that 73% of interviewees are willing to pay more for products deemed healthier, 12 percentage points higher than the global average. Factors behind the trend include rising incomes, the stressful effects of urbanization, an aging population and ongoing issues with food safety and quality

- Chinese consumers are not only seeking treatments but also prevention of health problems through exercise, diet and VMS products

- The report states that Chinese consumers tend to prefer traditional Chinese medicine (TCM) and products with multiple functions, as many of them are concerned about possible side effects of Western OTC products

- Other reports indicate that major channels for the OTC and VMS products are still though mainstream supermarkets and pharmacies, however, online e-commerce platforms are growing tremendously fast

OVER-CAPACITY – INDUSTRIES FACING SIGNIFICANT CHANGES

STEEL AND COAL (DE-CAPACITY)

De-capacity is the most important task set in the 13th FYP for some industries in serious over-supply.

- Over-capacity is one of the most critical problems the Chinese economy has been facing and the situation became worse during the 12th FYP

- Manufacturing capacity has been growing rapidly in China over the past decades since the reform and opening-up in the 1980s

- A growing number of industries have started to suffer from over-capacity since the 11th FYP

- The Chinese government started to attach importance to removing outdated capacity and tried to re-structure and consolidate various industries following the 12th FYP

- However, the over-capacity of many industries deteriorated further during the 12th FYP, mainly due to fierce competition and disorderly expansion

- As a result, the Chinese government started to re-structure the economic structure by initiating the ‘Supply-side Reformation’ since 2016 (the first year of the 13th FYP), instead of investment stimulation policies which had been widely used during the last decade

- The government launched a de-capacity campaign across all industries which were facing an over-supply problem, with an emphasis on the following ten industries which suffer heavily from serious over-capacity and low profitability (many of the companies are suffering from negative profit)

- Tier one de-capacity industries: Steel, coal, cement, plate glass and electrolytic aluminum

- Tier two de-capacity industries: Paper, oil refining, photovoltaic power generation, wind energy and thermal power

- The government has started to take unprecedentedly strong actions and measures to push de-capacity in the steel and coal industries since the first half of 2016

- It is widely believed that the government is testing the policies in these two industries and will further extend them to other industries later

Besides capacity reduction, new steel production and coal mining capacity construction will be strictly prohibited during the 13th FYP.

- De-capacity of the steel industry is a demonstration of the Government’s determination for ‘supply-side structural reformation’. It was launched nationwide at the beginning of 2016

- The de-capacity target set by the central Government is pretty conservative compared to the huge spare capacity because:

- The target is set to test the water, especially with regards to assessing the feasibility of laying off a large number of workers in state-owned enterprises, and dealing with banks’ bad loans

- Approval and construction of new capacity will be strictly prohibited over the next five years

- The de-capacity target set by the central Government is pretty conservative compared to the huge spare capacity because:

- For coal:

- Increase the industrial concentration by consolidating another 500 million MT of capacity to large and competitive mine operators

- Stop approval of new capacity construction over the next two years

ENERGY

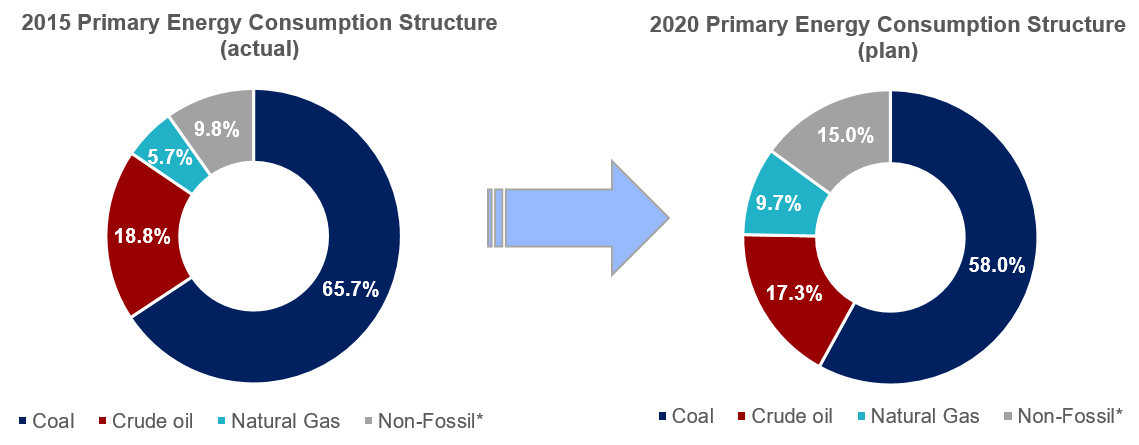

China will continually encourage generation of clean energy and non-fossil energy in the 13th FYP. Steps towards more efficient energy consumption are to continue.

- The Government will continually strengthen China’s green footprints by reducing the consumption percentages of coal and oil in the 13th FYP

The target set for non-fossil energy is 15% of total primary energy consumption by 2020 - Investment in energy storage and smart grids will be incentivized

- Investment in low-carbon public and private transport will continue at a faster pace

- Green buildings and green cities will be promoted

PROPERTY (DE-INVENTORY)

High inventory is the major challenge for property in China.

- Apart from the existing inventory, the land used by apartments starting construction or under construction is also large, which might lead to further inventory issues

- Over-development during the past decade, especially in tier 3 and tier 4 cities, is the major reason for high inventory in the property industry. Over the past decade, local governments in tier 3 and tier 4 cities, have been selling land aggressively in order to increase their revenue

- Real estate prices have been growing aggressively over the past few years, to far beyond the affordability of most residents

- Migrant workers in these cities cannot afford to buy apartments, or they and their family members do not have the right to enjoy the same social welfare as local citizens, from the perspective of household registration (Hukou)

- Population growth in tier 3 and tier 4 cities is slow, limiting demand growth

- The key action points in the FYP plan to counter high property inventories:

- De-stocking – fiscal policies to reduce demand

- Renovation of shanty houses and construction of low-income apartments

- Urbanization and enabling migrant labor access to housing investment

ENVIRONMENTAL INITIATIVES

ENVIRONMENTAL

Key Environment Issues Faced by China.

- Rapid and excessive industrialization has caused serious pollution in China

- Air pollution:

- In China, the average PM2.5 reading for 2015 stood at 50.2 μg/m³ versus the WHO standard of 10 μg/m³

- The national standard set by the Chinese government for the Second Level Zone is 35 μg/m³ but only 20% of cities met this standard in 2015

- Water pollution:

- Around 37% of the water resource in China is categorized as having quality of IV and V, meaning it is qualified for industrial use or agricultural use only

- 60% of underground water is not qualified for direct contact with humans

- Industrial waste is the major cause of water pollution in China, followed by sewage and agricultural waste water

- Land pollution:

- Overall, around 16.1% of the locations monitored were considered as polluted in 2014

- For cultivated land, forests and grassland, the % of sites monitored and considered polluted are 19.4%, 10.0% and 10.4% respectively

- Land pollution is more severe in the Yangtze River, Pearl River area and the Northeast China Industrial Zone area

- Heavy metal pollution is more severe in South West China and Central South China

- Steps to be taken in the 5YP:

- Air:

- VOCs will be included in the emission reduction target for the first time

- By the end of 2020, per unit of GDP carbon emissions to decline by 40-45% compared with that of 2005

- By 2030, per unit GDP carbon emissions to decline by 60-65% compared with 2005

- PM2.5 will be the key criteria used to evaluate air quality

-

Water:

-

-

The Government will launch new polices to further control and treat water pollution

-

By the end of 2020, the water quality of 70% of the area in seven key river basins (Yangtze River, Yellow River, Pearl River, Songhua River, Huai River, Hai River and Liao River) should reach Level III standard or above

-

By the end of 2020, in offshore areas, water quality of 70% of the area should reach Level II standard or above. Basically, water quality at or below Level V will be eliminated in coastal areas

-

For the Jing-Jin-Ji area (Beijing, Tianjin, Hebei), area with water quality at or below Level V should decline by 15%

-

Will shut down small-scale companies that cause serious pollution, this will cover industries such as paper, textile, leather and chemical

-

-

Land:

-

-

Government institutions including National Development and Reform Commission, Ministry of Environmental Protection, Ministry of Land and Resources, etc. plan to launch “Soil Environmental Protection and Pollution Control Plan of Action” in 2017

-

The plan will cover the following:

-

To identify key areas which are seriously polluted by heavy metals

-

To decide the amount of investment required to treat the key areas polluted by heavy metals

-

To divide the land into two types: for agriculture and for construction; to develop a timeline for land pollution treatment for each type of land

-

-

- Air:

Industries To Be Affected by Pollution Control:

INFRASTRUCTURE DEVELOPMENT (OBOR)

TRADE INFRASTRUCTURE INVESTMENT (OBOR)

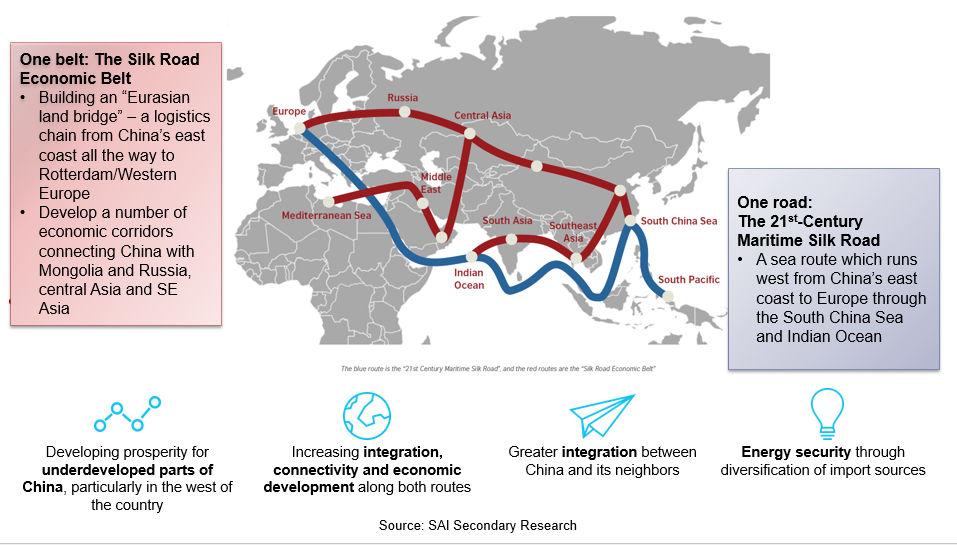

Developed in 2013 by President Xi Jinping, the One Belt One Road (OBOR) concept is part of China’s strategic intent to secure trade channels globally. Although still in its nascent stages, the OBOR policy is underpinned by strong Asian Bank support and very centralized Chinese Government control. Assets are already being secured offshore in Africa, Australasia, West Asia and South East Asia. It has two main elements:

WHAT IS OBOR INITIATIVE?

- Implicit objectives of OBOR

- The OBOR initiative is being managed by a small group under the chairmanship of Vice-Premier Zhang Gaoli. In the Chinese government, the National Development and Reform Commission (NDRC), Ministry of Foreign Affairs and Ministry of Commerce have been tasked to deliver OBOR, with the NDRC playing a coordinating role

- This initiative is being led by large, G2G infrastructure projects with initial financing support from the Asian Infrastructure Investment Bank. Private companies are also being actively encouraged to invest along the Belt and Road

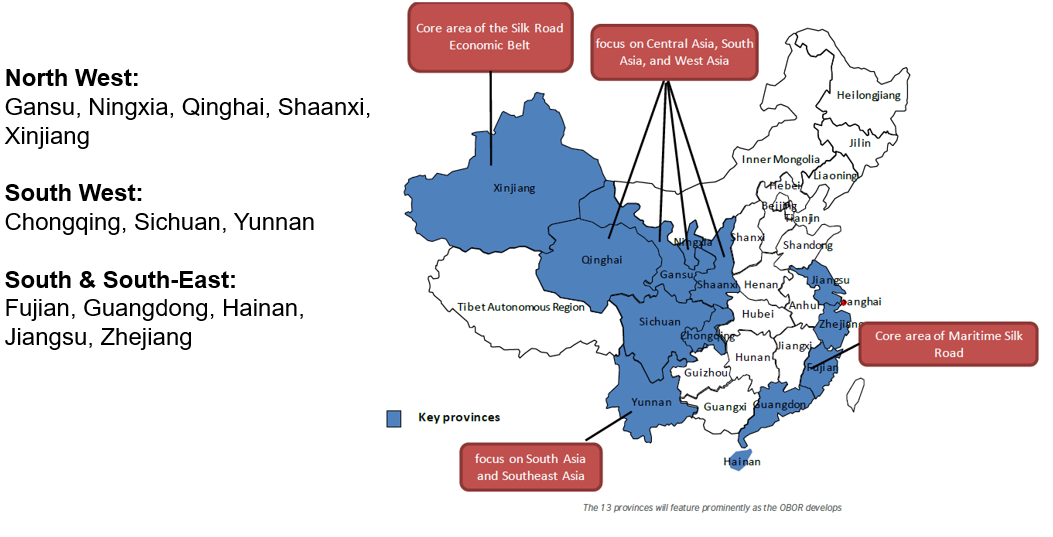

OBOR OPPORTUNITIES WITHIN CHINA

- Within China, Xinjiang and Fujian are the two locations at the heart of the OBOR initiative

- Xinjiang, in the north-west, has been designated as the “core area” of the land-based Silk Road Economic Belt, and the natural hub for routes to central Asia, Russia and Europe

- Fujian is the equivalent area for the 21st-Century Maritime Silk Road

OBOR INITIATIVE REQUIRES NEW POLICES AND REFORM TO SUPPORT ITS IMPLEMENTATION

- A key objective of OBOR is to accelerate the pace of development in China’s less developed provinces and cities, particularly those in the west and central regions. China will be investing heavily in these regions to develop the necessary infrastructure and conditions needed for them to fulfill their potential. At the same time the more established coastal and eastern regions remain integral to the success of OBOR. Outside China, OBOR’s reach will stretch far beyond the 64 countries detailed in the initiative, encompassing developed and developing countries in Asia, Africa, Europe and the Middle East

- As the initiative’s implementation process continues, reforms will need to be realized both within and outside China, including the improvement of financial integration, trade liberalization and the opening of markets

- Central level:

- The General Administration of Customs has announced measures to reduce non-tariff barriers and to integrate customs clearance along the routes

- The Ministry of Commerce plans to strengthen energy and infrastructure investment cooperation with neighboring countries

- The Ministry of Transport plans to develop international freight lines and the airline network with countries along the routes

- Local level plans will be announced by individual provinces later in 2016

- Central level:

RECOMMENDATIONS

- The Chinese economy will adjust to the ‘New Normal’ stage

- GDP growth is targeted at 6-7%, however, there are significant risks that this could indicate periods of growth lower than 6%

- The Chinese Government is aware that economic development has entered a bottle-neck stage, and it intends to employ more administrative measures to solve the problems which are hindering economic growth and re-structure the economy during the 13th FYP

- As a result of the above situation, SAI would suggest multinational companies

- Monitor the policies carefully. They will be continually released by the central Government and local government, as the policies are supposed to play an important role during the 13th FYP

- Closely monitor the changes that will take place along the whole industrial value chain, to see the effectiveness of the policies, impacts on different participants, and potential specific impacts on multinational companies

- SAI has seen companies successfully expand businesses in China through standard organic growth based on strong value propositions already accepted in the West, but also through localization of offers including acquisitions and development of local brands and access to domestic markets. These successful strategies have all required very good understanding of local policies and their business implications

- The new FYP will cover a unique period in which, for the first time, the outlook of the Chinese economy is quite uncertain and hard to anticipate. SAI believes the situation will bring unprecedented challenges to multinational companies with respects to their strategic plans in China. SAI recommends that clients closely monitor specific fields or segments as these become the focus of policy announcements

SAI is well-placed to support your business decisions in China and globally. Please contact us for support in strategic or tactical market intelligence and analysis.

CONTACT SAI

About SAI

- SAI is an international business intelligence and research firm with over 35 years of experience providing clients with fact-based intelligence and analysis derived from extensive interviewing and secondary research

- International capabilities through offices in all major global regions

- Headquartered near Philadelphia, USA

- Staff based in key centers in Asia Pacific since 1993 including Beijing, Shanghai, Taipei, Singapore, Tokyo, Mumbai, Delhi, Melbourne

- Strong presence in major Asia Pacific countries

- 25-year track record in Greater China

- Experienced team on the Indian sub-continent, also covering the Middle East and Africa

- Extensive staff and strategic partners in Southeast Asia and Australia

- Strong capabilities in Japan/Korea through own staff and strategic partners

- Highly trained staff with:

- Commercial insight and rich industry experience

- MBA’s and technical undergraduate degrees

- Unique interviewing techniques

- Multi-lingual skills covering major Asian languages

- Understanding of local business practices and cultures