Africa – Demographic Overview

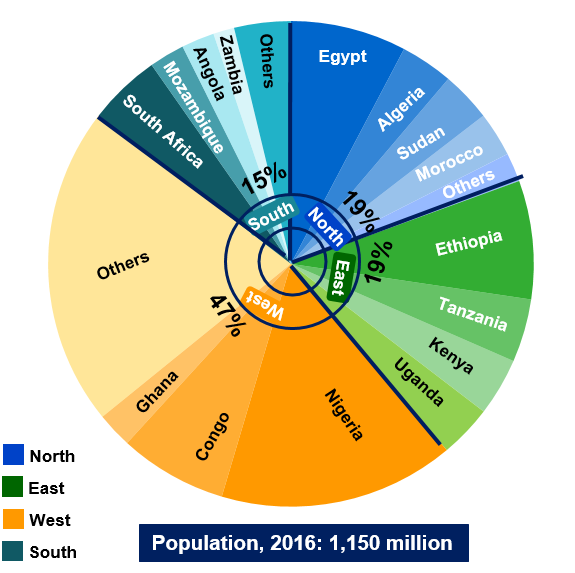

Population Overview By Region, 2016

- Total population in Africa is estimated at around 1.15 billion in 2016, and is forecast to reach to ~1.25 billion by 2020

- West Africa is the most populous region with 47% of total population, followed by East and North Africa at 19% each

- Africa is expected to witness the world’s largest population growth up to 2050, expected to reach 2.3 billion by that year

Source: IMF, World Bank, SAI’s non-confidential databases

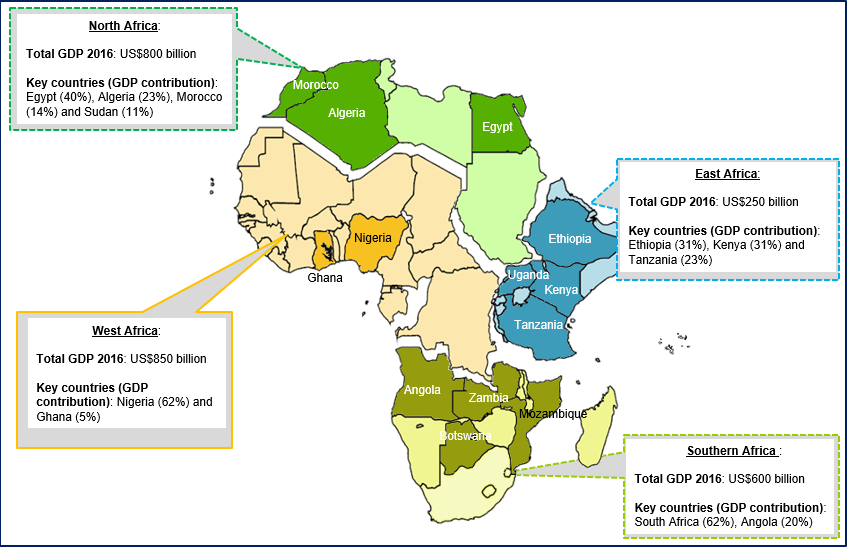

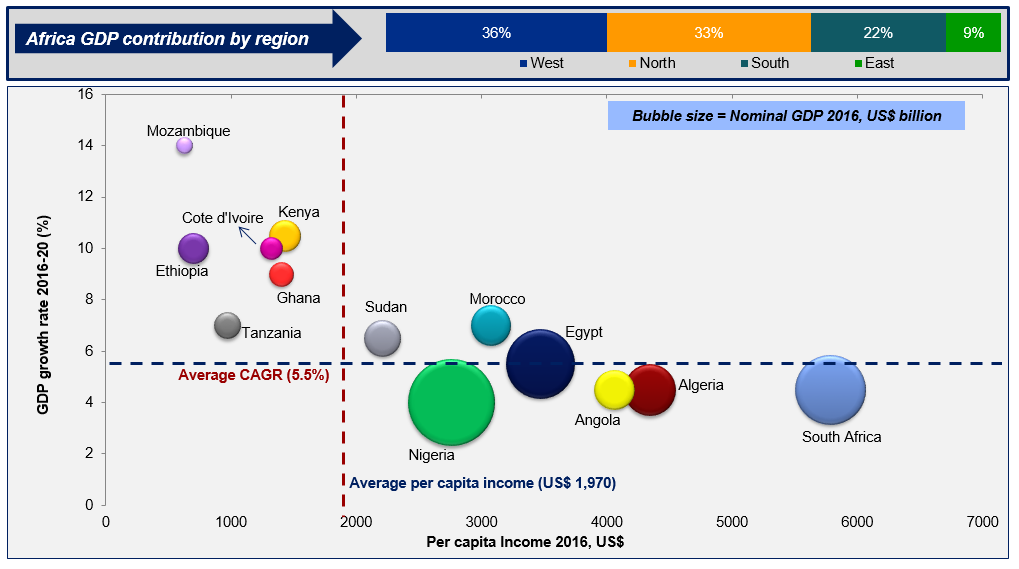

Africa – Economic Overview

- Africa’s overall GDP in 2016 was US$2.5 trillion and is expected to grow at ~5% CAGR to US$3 trillion by 2020

- South Africa, Nigeria, Egypt, Algeria, Morocco and Angola are the top six countries driving economic growth in Africa

Source: IMF, World Bank, SAI’s non-confidential databases

- With overall GDP CAGR of around 5-6% projected over the next 4-5 years, Africa continues to emerge as an important destination for international business and foreign investment

- Relative attractiveness of key countries is placed below

Source: IMF, World Bank, SAI’s non-confidential databases

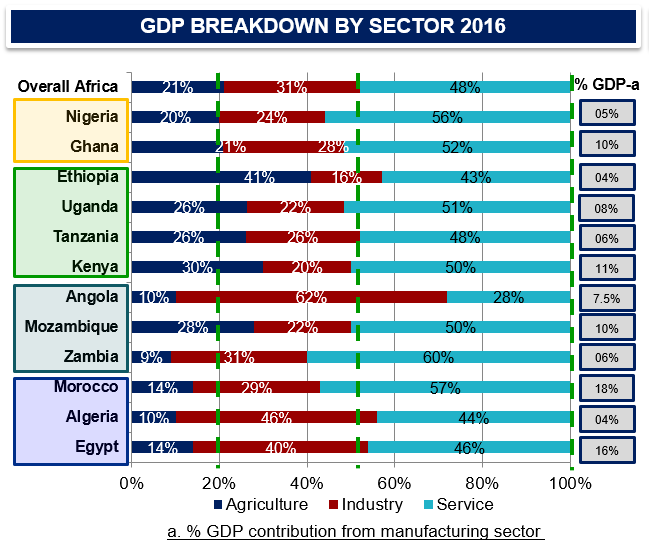

GDP Breakdown By Sector

- Africa has abundant natural resources including oil, diamonds, gold, iron, cobalt, uranium, copper, bauxite and others

- Overall, service sector accounted for around 48% of total GDP, followed by industry at 31% and agriculture at 21%

- Angola, Algeria and Egypt have highest contribution of industry to GDP, while contribution of agriculture is most significant in Ethiopia

- Service sector contributes to more than half of GDP in Zambia, Morocco , Ghana, Uganda, Kenya, Mozambique and Nigeria

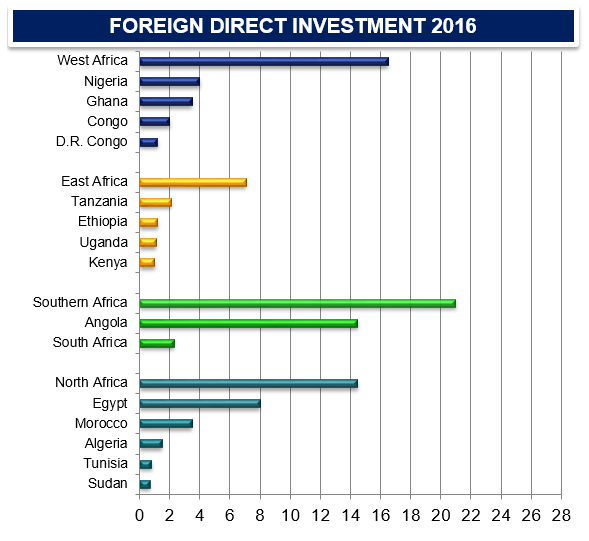

Foreign Direct Investment, 2016

- Total FDI in Africa is estimated at ~US$59 billion in 2016. FDI Inflows to the continent remain unevenly distributed, with five countries (Angola, Egypt, Nigeria, Ghana and Ethiopia) accounting for 57% of the total

- FDI inflows to Africa are expected to increase in 2017, to $65 billion, in view of modest oil price rises and potential upturn in non-oil FDI. Growing regional integration drives Africa’s competitive global integration and encourages stronger FDI

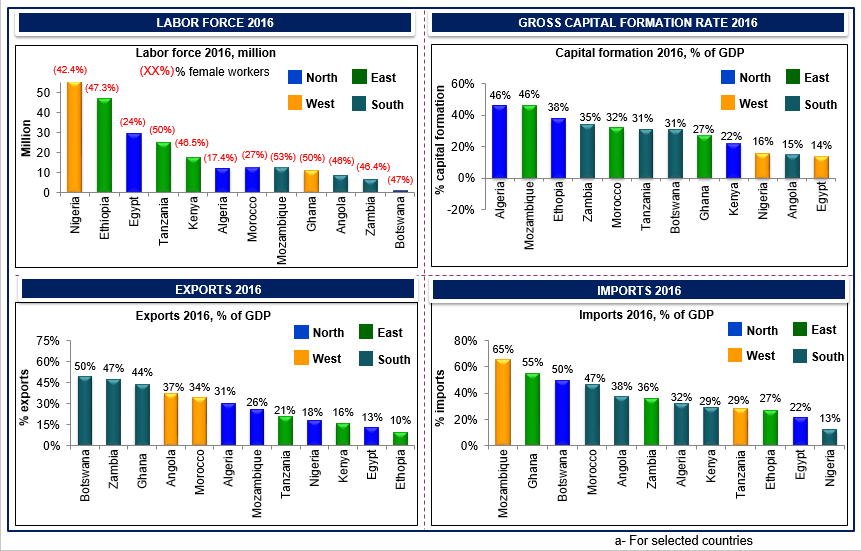

Africa – Other Key Macro Indicators – a

- Exports from Africa were an estimated US$325 billion in 2016, while imports were around US$460 billion. Increasing investments in manufacturing sector are expected to provide significant boost to capital formation, especially in West and North Africa

Source: World Bank, TradeMap, UNData, SAI’s non-confidential databases