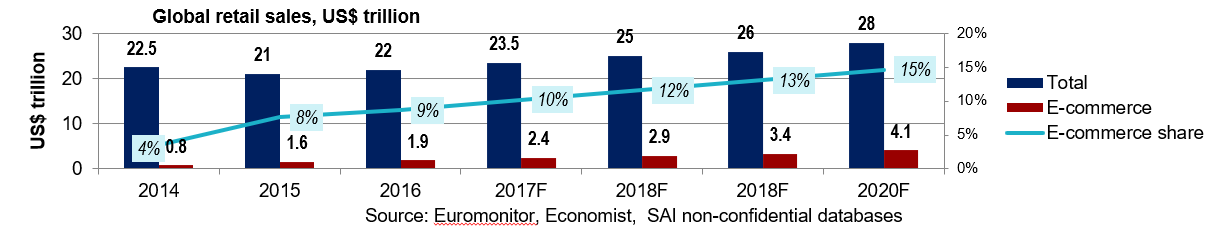

Despite rapid growth over last 10 years, e-commerce still has large penetration potential globally

- Global e-commerce:

- Has been expanding at ~20% CAGR over the last 10 years

- Still had <10% share of retail trade in 2016, ranging from:

- Almost 20% in South Korea, to

- 10% in the United States, to

- Only 5% in some major emerging economies such as India and Brazil

- United States and China are by far the two largest e-commerce markets

- 2016 online sales are estimated at:

- China: ~$365 billion

- United States: ~$310 billion

- E-commerce share is projected by 2020 to account for:

- ~35% of retail sales in China

- >15% of retail sales in the United States

- 2016 online sales are estimated at:

- According to DHL, 15% of current e-commerce sales are currently cross-border and this should exceed 20% by 2020 as leading e-commerce firms grow outside home markets and logistics networks become more integrated globally

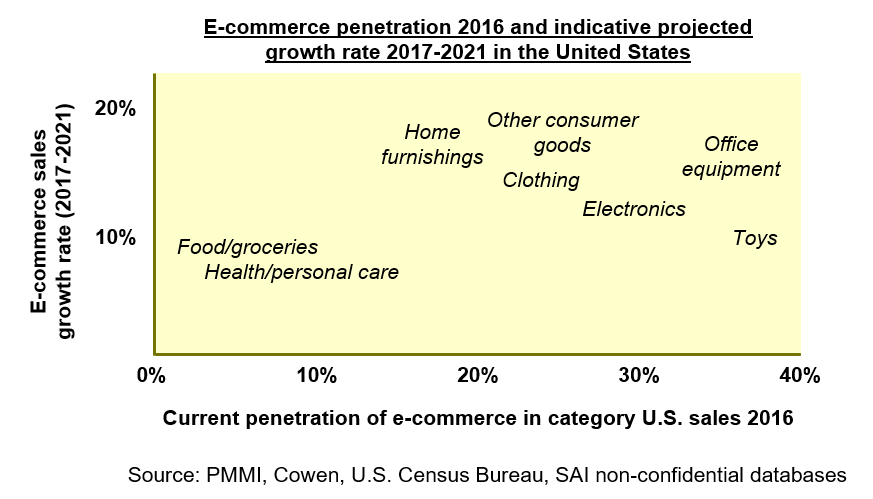

E-commerce sales are expected to continue growing briskly across major product categories in the United States

- Aside from books, which have already shifted substantially to online sales, highest e-commerce share penetration potential in the United States continues to be seen in office equipment, electronics, toys, clothing, home furnishing and other consumer goods

- Online sales of food and beverage, pharmaceuticals/nutraceuticals and other CPG (consumer packaged goods including home & personal care, beauty & cosmetics) are expected to show more modest, but steady gains from a low penetration base, but will still have major impact on e-commerce packaging demand and trends due to their absolute volumes

E-commerce is driving changes in packaging at multiple levels

- Brands and CPG manufacturers are having to reassess how they package products for the online shopper and to adapt to new generations of tech-savvy consumers

- Key trends in e-commerce packaging include increasing commitment to sustainability alongside need for cost-effectiveness of operations, for example:

- Easy-to-return packaging (e.g. with resealable plastic mailers, corrugate with tear strips)

- Second-life (re-useable) packaging

- PEFC (Programme for the Endorsement of Forest Certification) certification

- Paper as fill, including pre-consumer recycled material

- Key packaging-related consumer concerns include:

- Integrity of packaging upon delivery (no damage)

- Size of package relative to items(s) being shipped

- Excessive volume of secondary packaging

- Ease of opening

- Overall user-friendliness, including instructions

- E-commerce is also generating demand for innovative packaging with radio frequency identification (RFID) and smart features optimized for last-mile delivery

- As the Internet of Things (IoT) expands, auto-replenishment services (e.g. Amazon Dash Button) are also impacting how products are purchased

- Online purchases create opportunities for richer brand experiences through video, 3D visualization, options for personalized packaging, “decorate-it-yourself” labels, portion-controlled snack boxes (e.g. Graze) that are customized by buyer for shipment, etc.

Source: PMMI, Jabil, SAI non-confidential databases

E-commerce creates need for “omnichannel” branding and primary packaging designs that work both online and in-store

- In e-commerce, the so-called “First Moment of Truth” (FMOT) of a product’s visual impact on the retail shelf is replaced by what Google has termed the “Zero Moment of Truth” (ZMOT), as consumers research products or services online before making purchase decisions

- Respondents to a 2015 PMMI survey differed in how they see the impact on packaging design

- Some argued for unified primary packaging design between online and retail sales, to limit number of SKUs and associated costs, and ensure brand consistency

- Others believed primary packaging may differ between online and retail sales as:

- Online channel gives rise to different strategies and target consumer groups

- E-commerce packaging does not need to be so attractive as sale has been made

- Either way, branding and graphics remain important for online sales both when consumers comparison shop online and when they “unbox” a product after delivery

- In physical stores, sales are influenced by location in store, available product selection and opportunity to touch or experience (smell/taste) products

- Online, products frequently have to stand out from a mass of competing products, and design (including primary packaging) is one key point of differentiation

- With increasing use of smartphones for online purchases, primary packaging also needs to be effective both online and offline, with consistent brand messaging across channels

- Creates need to adapt traditional package designs for viewing on small mobile devices and distil brand and package design down to essential messages

Source: SAI non-confidential databases, PMMI, trade press

E-commerce has particular impact on protective packaging demand and requirements

- E-commerce shipping cases must be strong enough to withstand a substantially more complex, and less automated, supply chain than for traditional retail

- According to Nestle, products may be handled 20+ times in e-commerce vs. 5 for in-store

- Cost of replacing destroyed item can be over 15 times the cost of shipping

- Negative online reviews from damaged goods can take months to counterbalance

- Consumer surveys indicate that large majority of online shoppers have at some time received a package with damaged items, and in such cases are unlikely to buy from that supplier again

- Parcel shipments of individual products create new packaging challenges due to rougher handling, risk of parcel movement, and greater protective function for secondary packaging

- In protective packaging:

- Flexible packaging (protective mailers, air pillows, bubble packaging, dunnage bags, paper fill products, etc.) will continue to dominate due to cost efficiency and versatility

- Foam packaging (molded foams, rolled foam, insulated containers, foam-in-place polyurethane, loose fill etc.) is second largest segment, still popular for consumer durables and manufactured goods

- Rigid packaging is growing from low base as molded pulp and paperboard protective elements benefit from sustainability trends

- For e-commerce retailers, last mile delivery is most common source of damage and most difficult to control, and calls for:

- Close collaboration between online retailer and logistics provider on packaging needs

- Upfront engineering to identify shipping contingencies

- Service Level Agreements with logistics provider to cover manufacturers’ needs

Source: SAI non-confidential databases, PMMI, trade press

Process improvements and operational efficiency are key to reducing overall supply chain cost of e-commerce packaging

- Order fulfillment will increasingly be performed by multiple connected players, including manufacturers, 3PLs and numerous independent packers, drivers, and parcel shippers, impacting supply chain accountability for damage in transit and last mile delivery, and raising importance of packaging for both protection and enhancement of customer experience

- E-commerce is having particular impact on both processes and materials for secondary and tertiary packaging, including speed and flexibility of packaging equipment, and durability and size of shipping cases

- Intelligent and scalable automation and packing systems will be needed to model, prompt and correct practices of human packers as volumes escalate

- Implications and opportunities for packaging machinery suppliers include:

- Automatic taping machines that can affix more or wider tape onto boxes for shipping

- Inexpensive, reusable components that are easy to load and reload

- Robots that can place products in corrugated boxes with human quality control

- Use of higher graphics printing

- Flexibility to divert products into different numbers of case-packing machines

- Opportunities to customize size of boxes to minimize shipping costs

- Ability to provide recommendations to customers on suitable suppliers of boxes and other materials that are compatible with their machinery

Source: SAI non-confidential databases, trade press

Increasing focus on customized packaging that is optimally sized while still fit-for-purpose for item(s) being shipped

- As shipping rates continue to rise, package sizes will need to shrink continuously while maintaining adequate protection or ensuring consumer satisfaction

- With increasing warehouse rental rates, supply chain participants need to identify and eliminate inefficiencies and maximize space utilization, including selection of space-efficient packaging materials

- Some major e-commerce retailers have begun using new box-on-demand technology that customizes case sizes to exact size of product(s) being shipped

- Eliminates need to warehouse multiple case sizes, reduces over-packaging, decreases or eliminates protective packaging, and optimizes case sizes

- Eliminates need for void fill, such as packing peanuts and other cushioning

- Optimizes volume of cardboard needed to make specific box sizes

- Protects product better from damage during transport

- Can produce boxes in real time, with case sizes managed automatically through product recognition or directly from a database

- Customization and personalization in delivery and logistics will be key differentiators as suppliers try to compete beyond delivery date, price and terms by meeting consumers’ delivery preferences, handling return shipments, and using packaging materials that can be recycled in the local area

Source: SAI non-confidential databases, trade press

Sustainability is driving greater use of recyclable and compostable packaging materials and related innovation

- Companies shipping products are increasingly paying attention to sustainability, driven by concerns about:

- Customers’ perceptions

- Quality and functionality

- Cost (often cited as a barrier to expanding e-commerce sales)

- High level of returns in e-commerce (20-30% versus <10% in traditional retail) due to:

- Less opportunity to physically evaluate products before purchase

- Higher risk of damage during transit

- Environmental impact of packaging used, including its:

- Recyclability

- Compostability

- Where required for shipping (e.g. void fill, cushioning, blocking, bracing, and wrapping) suppliers are introducing more sustainable alternatives to traditional materials, such as:

- Polyethylene air cushioning and bubble wrap from recycled content

- 100% renewable, recyclable and reusable paper packaging

- 100% recycled-content and recyclable molded pulp packaging

- Innovations include:

- Mushroom root-based packaging (Sealed Air’s Restore® Mushroom® Packaging) as alternative to expanded polystyrene

- YFY Jupiter’s Npulp® based on waste straw from Chinese wheat and rice farming

Source: SAI non-confidential databases, trade press

Rapid growth in online grocery sales in particular creates need for cost-effective shipping solutions for low value items…

- While e-commerce has traditionally focused on non-consumable products, online sales of grocery products have grown at double digit rates over the past several years, versus only 3% annually for in-store sales

- Control is shifting from retailer to manufacturer and distributor, and power in the channel is held by those that manage inventory

- Manufacturers need to considering selling direct-to-consumer (DTC) and developing a specific supply chain for this channel

- DTC e-commerce enables better brand management in online channels

- Introduces expense of develop entirely new supply chain to support e-commerce, and cost of shipping heavier grocery items, among others

- E-commerce accounted for <1% of grocery sales in 2012, but is projected to exceed 15% within the next five years by some retail consultancies, driven by:

- Consumer convenience, above all

- Online shopping preference of “Millennials” that are increasing buying for own households

- Ease of shopping across multiple devices

- Same-day delivery, and greater pick-up and delivery options

Source: SAI non-confidential databases, trade press

… especially in response to adoption of dimensional weight pricing by freight carriers

- There e-grocery models have emerged

- Home delivery (e.g. Amazon Fresh, FreshDirect, Netgrocer.com, Peapod, Schwan’s)

- Insulated plastic totes are often used for unattended deliveries, allowing for later delivery or subsequent collection by the consumer

- Click and collect (e.g. Walmart, Kroger)

- Consumers order groceries online from physical stores, and collect purchases at specified locations

- Personal shoppers (e.g. Instacart)

- Online grocery service under which consumers order products online and personal shoppers select the items from various stores and deliver directly to the consumer

- Home delivery (e.g. Amazon Fresh, FreshDirect, Netgrocer.com, Peapod, Schwan’s)

- Particular challenge for retailers is shipping lower-value products, especially those that are dense or lightweight, to consumers quickly while keeping costs down

- In past, retailers were charged for freight based on weight of package

- Since 2014, many carriers have introduced new pricing method for freight called dimensional weight, or volumetric weight, pricing, and now charge for whichever measure is higher, package weight or size/dimension

- Incentivizes use of lighter weight packaging materials

Source: SAI non-confidential databases, trade press

Foodservice packaging is also impacted by retail e-commerce packaging trends

- In its latest Trends Report, the Foodservice Packaging Institute highlights the proliferation of food delivery options for today’s consumer, including:

- Meal kits and delivery programs

- Prepared food couriered by third-party vendors

- Take-out and delivery options from traditional dine-in foodservice establishments

- These delivery options raise additional performance requirements for foodservice packaging to ensure that meals are delivered hot, fresh and safe to consume, with appropriate branding

- Related trends include continued interest in tamper-evident packaging and food safety, including innovations like time and temperature color-changing indicators/labels for home-delivered meals that help keep food fresh and safe

- Industry participants continue to observe a movement away from polystyrene to other resins, paper and molded fiber due to growing interest in foodservice packaging that can be recycled and / or composted

Source: Foodservice Packaging Institute (FPI)

Meal kit delivery services are a fast growing sub-segment of the grocery/food service market

- Meal kit suppliers have responded to consumer concerns about packaging waste by:

- Creating outer shipping boxes and packing materials that are fully recyclable and compostable, made from sustainable materials

- Sourcing green packaging for meal components that is recyclable or compostable

- Creating freezer packs that contain mostly water and no toxic fluids

- Pre-labeling and pre-paying for shipping containers to be returned for reuse

- Market examples (illustrated on next slide) include the following:

- Plated.com switched in 2015 from corrugated shipper, insulated plastic liner, and frozen gel packs for its meal-kit ingredients to shipper made from 100% recycled fiber and recycled jute sacks (to replace liner) from discarded burlap bags for coffee and cocoa

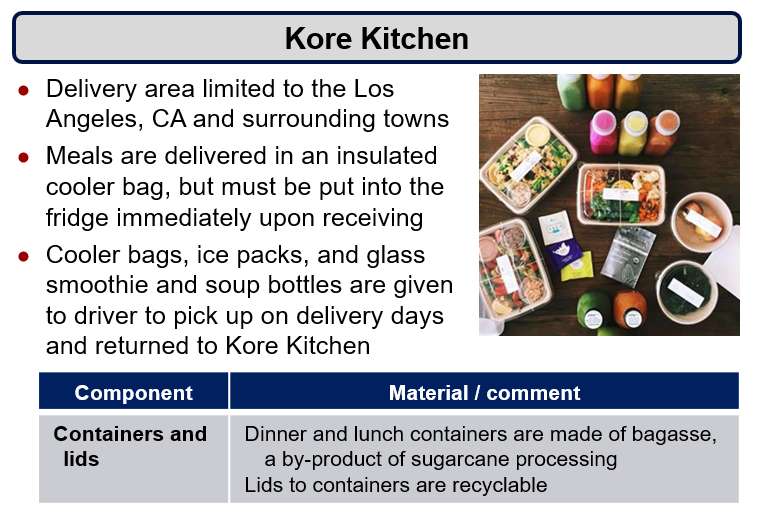

- Kore Kitchen in early 2016 moved to glass and biodegradable packaging. Uses:

- Biodegradable non-laminated containers from Sabert made from bagasse, a byproduct of sugarcane processing

- “Greenware” salad dressing containers from FabriKal made of compostable polylactic acid derived from corn

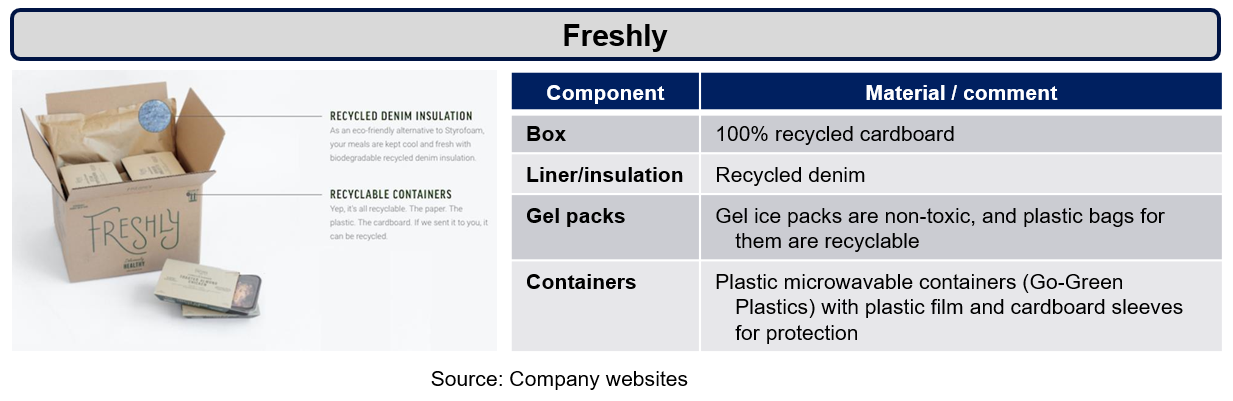

- Freshly, a ready-to-eat meal delivery service, introduced a “new, sustainable look, Freshly 2.0.” in 2016

- Eliminates use of dry ice and expanded polystyrene

- Replaces them with biodegradable, recycled denim and nontoxic, water soluble and recyclable gel packs

Source: SAI non-confidential databases, trade press

Meal kit packaging examples

Pharma industry is increasingly adopting e-commerce as a sales channel, including for temperature-sensitive products

- In 2015, Pharmaceutical & Medical Packaging News surveyed supply chain professionals to better understand activities of manufacturers of pharmaceuticals, medical devices, and other healthcare related products related cold-chain packaging. Select findings include:

- Share of temperature-sensitive products shipped by type (rounded)

- 30% refrigerated products

- 15% frozen products

- 50% controlled room temperature products

- 30% products that cannot be allowed to freeze

- Share of cold-chain packaging used by type (rounded)

- 40% off-the-shelf solution

- 20% custom-designed packaging

- 40% mix of both off-the-shelf and custom-designed packaging

- Share of temperature-sensitive products shipped by type (rounded)

- Key conclusions of the survey were that:

- Less than 20% of companies had allocated resources to develop a complete, customized packaging line for cold-chain pharma packaging

- Products are often shipped in packaging that is either over- or under-engineered, increasing costs or potentially putting patients in danger

- Only one-third of respondents prioritize packaging and understand its cost implications

- More than half of respondents have goal of <0.5% rate of spoilage in transit, but typically fail to achieve that

Source: Pharmaceutical & Medical Packaging News, SAI non-confidential databases

Spending on transport of temperature-controlled drugs is growing at roughly double the pace for pharma products overall

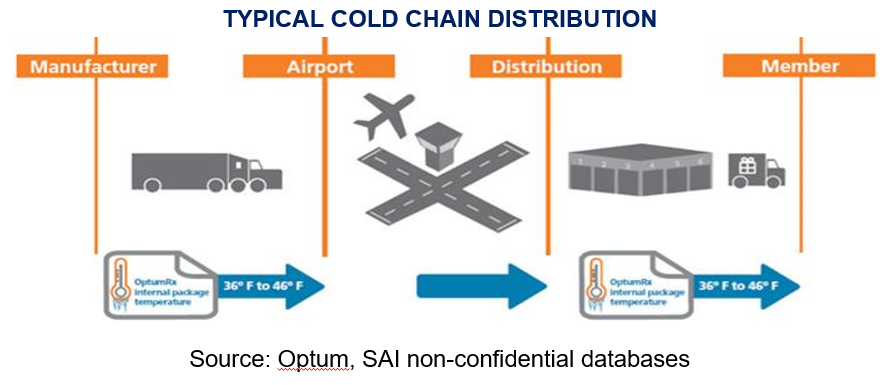

- In pharmaceuticals distribution, a cold chain is a system of refrigerators, cold storage facilities and disposable cold boxes, organized so that temperature-sensitive medications are kept at right temperature from factory to point of use

- Keeps sensitive medicines within designated temperature range as they move through supply system

- Doubling of cold-chain use is primarily due to growth of biologic drugs, although insulin products and vaccines (which also require cold chain) also continue to grow strongly

- In contrast to conventional drugs, biologics are manufactured inside a living system, such as a microorganism, or plant or animal cells, and are often sensitive to temperature extremes during shipment

- U.S. FDA requires that refrigerated biologics be stored and transported at 2°C to 8°C (36°F to 46°F) – unless a medicine is stable at other temperature ranges

- Between 2015-2020, shipping of products that require cold chain transport is projected to rise by over 50%, double the rate of increase in non-cold-chain products

Cold chain packaging is evolving in line with market requirements

- Close to $250 billion of cold-chain biopharmaceuticals is estimated to have been in distribution by 2016, up by over 50% from 2010

- Majority of biotech products, vaccines, blood products and other injectables require refrigerated (2-8°C) storage and transport

- Regulatory requirements for “controlled room temperature” (CRT) storage (15–25°C) and transportation are tightening, and cover most pharmaceuticals

- In recent years there has been move back to “passive” (non-powered) containers, including for pallet-size shipments

- Related innovations include hard-cased and reusable systems, vacuum-based insulation panels, compact composite container walls and various phase-change materials used in gel packs to provide cooling

- Each type of passive cooling system has pros and cons

- Weight and size are key cost drivers for air freight, and optimization of container size versus payload is key to providing a cost-effective solution

- Sustainability initiatives to reduce waste from used packaging materials are also impacting package selection

- Next generation of effective insulated packaging protects temperature-sensitive payloads from uncontrollable and unpredictable factors, such as ambient temperatures and transportation delays

Source: Pharmaceutical Commerce, SAI non-confidential databases