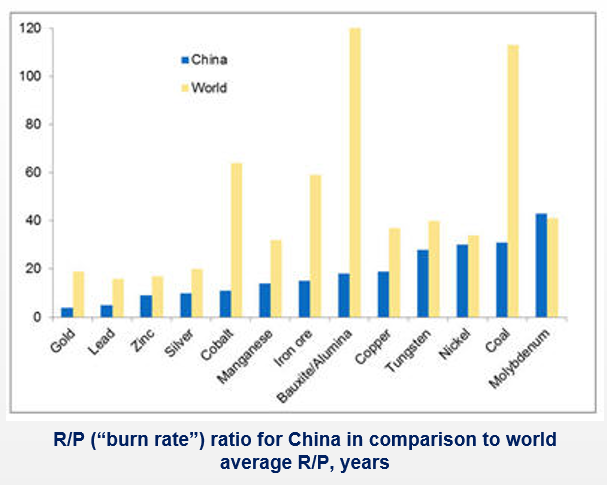

CHINA’S MINERAL RESOURCE “BURN RATE” IS SIGNIFICANT

- China is facing a rapid depletion of its local mineral resources

- Reserves-to-production (R/P) ratio that represents the “burn rate” of proven reserves of mineral commodities when applying current levels of domestic mine production shows that China is in the “red zone” for future supplies of nearly all crucial minerals

- In order to overcome shortages of essential mineral commodities, as well as to secure long-term sustainable supplies for its ambitious economic development strategy, the Government of China empowered and encouraged a number of domestic state-owned and private companies to actively pursue mining deals throughout the world through a strategy known as “Two Resources, Two Markets” and advocates for the pursual of mining projects all over the world, as further described on the following pages

“China’s ‘top down’ strategy of acquiring assets with a vision of controlling the production of ore and higher margin goods further along the supply chain is still alive and well despite the country’s economic challenges” – Chris Berry, an Analyst at House Mountain Partners in New York

CHINA’S TWO RESOURCES, TWO MARKETS STRATEGY

- Introduced to China in the 90’s, the strategy’s goal is to supplement domestic production with imported commodities in order to build up reserves and strengthen commercial position

- China employs this strategy across all sectors, including mining, telecommunications, agriculture and others

“Two resources, two markets calls for a mutually beneficial and complementary outcome in globalization, creating a diversified multi-supplier system for resources”

China’s response to the United States definition “China’s Answers to the Panel’s Written Questions Subsequent to the First Substantive Meeting with the Panel March” 2013

“Shorthand reference for the strategy of leveraging China’s comparative advantage in certain resources for China’s economic advantage and a strategy of leveraging China’s reserves in rare earths and other raw materials to obtain advantages for China’s manufacturers of downstream products”

United States Trade Representative definition used to provide the policy context for China’s use of export restraints “China’s Answers to the Panel’s Written Questions Subsequent to the First Substantive Meeting with the Panel March” 2013

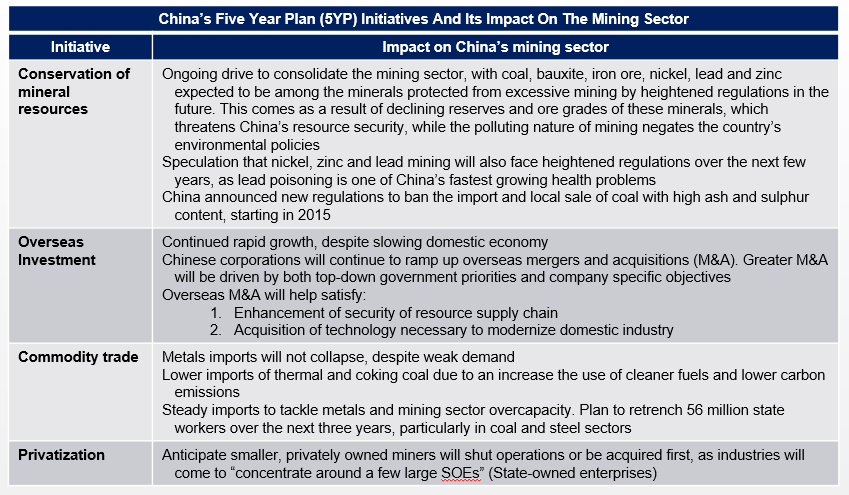

CHINA’S 13TH FIVE YEAR PLAN INCLUDES THE MINING SECTOR

- China’s 13th Five Year Plan (5YP) (2016-2020) is a continuation of China’s series of five year social and economic development initiatives and attempts to map strategies for economic development, set growth targets and launch reforms

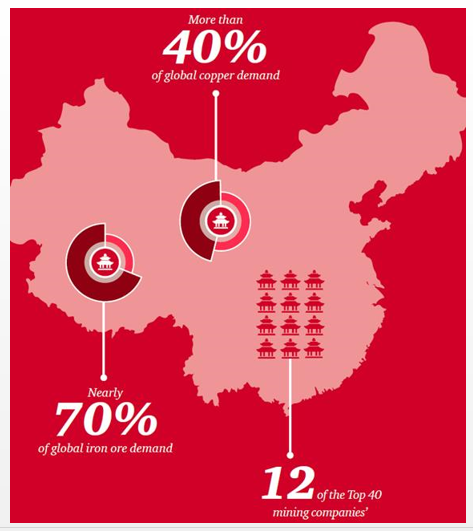

CHINA HAS SIGNIFICANT DEMAND FOR IRON AND COPPER

- The graphic below depicts China’s percentage of global demand for iron and copper

CHINA HAS TWELVE OF THE TOP 40 GLOBAL MINING COMPANIES

- China Shenhua Energy

- China Coal Energy

- Zijin Mining

- China Northern Rare Earth (Group) High-Tech / Inner Mongolia Baotou Steel Rare-Earth Hi-Tech

- Shaanxi Coal Industry

- Jiangxi Copper

- Sichuan Tianqi Lithium

- Tongling Non Ferrous Metals Group

- Yanzhou Coal Mining

- Zhingjin Lingnan Non Ferrous Metals

- Shandong Gold Mining

- Inner Mongolia Yitai Coal

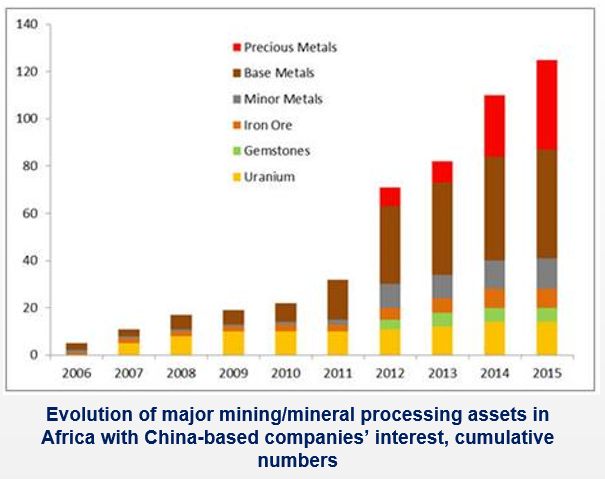

AFRICA IS DESIRABLE TO CHINA

- Africa quickly became the most desirable region for China and Hong Kong-based companies hunting for mining deals globally including:

- South Africa, a top producer in chromium and gold

- Botswana, a forerunner in diamonds and other gemstones

- Democratic Republic of Congo, containing the world’s largest underdeveloped copper reserves

- In less than 10 years since Chinese authorities called for mineral resources diversification globally, the number of major mining/mineral processing assets in Africa with China-headquartered companies interest, increased from only a handful in 2006 to more than 120 in 2015

- Many of China-Africa deals are not always made public, an adjusted number of China-controlled mining assets in Africa could be even larger

- Forms of mining deals that China employs in Africa are diverse and involve direct investments in mining projects, infrastructure investments–to-mineral resources “trade-in” deals, joint ventures, indirect investments, off-take agreements, options and a variety of other structures

CHALLENGES IN DETERMINING CHINESE OWNERSHIP

- Chattam House noted that the data used in analysis of investment pipelines for 2007-13 had “significantly under-reported investment in China and other emerging economies, which is often not, or only partially, reported outside these countries”

- IntelligenceMine / Mining.com reports determining mining assets in Africa and that “an adjusted number of China-controlled mining assets in Africa could be even more impressive” due to:

- Deals are not always made public. Recently Gecamines, the state-owned Democratic Republic of Congo mining company, violated transparency rules by failing to publish agreements signed last year with China Nonferrous Metal Mining and Glencore

- Mining deals employed by China are “diverse and involve direct investments in mining projects, infrastructure investments–to-mineral resources “trade-in” deals, joint ventures, indirect investments, off-take agreements, options and a variety of other structures”

- Thus, it is a real challenge to get a completely accurate statement of Chinese ownership of key commodities globally

- Insights into the situation for various metals/minerals appear on the following pages

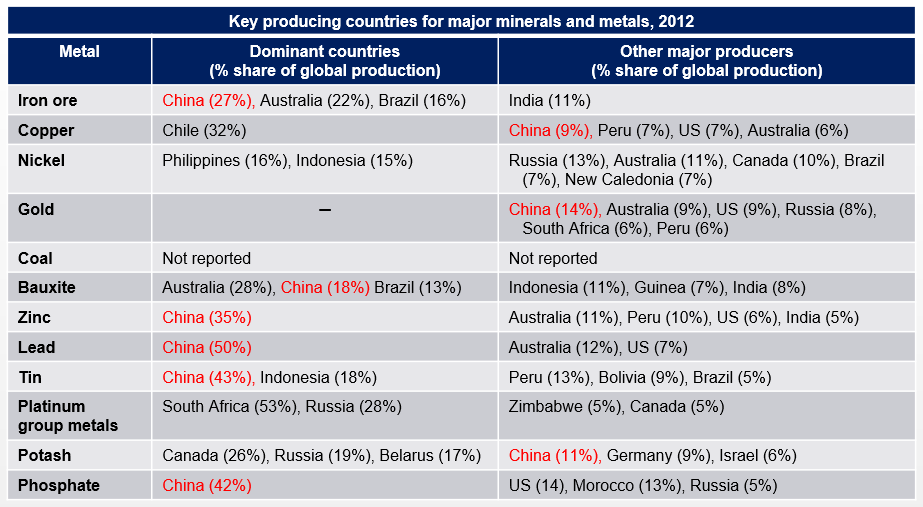

GLOBAL MINE PRODUCTION IS CONCENTRATED IN ELEVEN MINING COUNTRIES

- Large-scale mining activity is concentrated in a few countries, providing only a handful of governments with the opportunity to affect aggregate supply and world market prices

- Bulk of metals and minerals is extracted in just 11 countries: four Organisation for Economic Co-operation and Development (OECD) countries (Australia, Canada, the United States and Chile), the BRIICS countries (Brazil, Russia, India, Indonesia, China and South Africa) and Peru

- Major mining countries share several common characteristics: a large, resource-rich landmass which has been relatively well explored, sufficient infrastructure to connect mines with international markets and a solid skills base

COAL

- According to a National Energy Administration (NEA) of China, an energy regulator, China will aim to close more than 1,000 coal mines over 2016, with a total production capacity of 60 million tonnes, as part of its plans to tackle a price sapping supply glut in the sector

- China plans to lay off 1.8 million coal and steel workers as part of the government’s ongoing efforts to reduce industrial overcapacity

- China is the world’s top coal consumer but demand has been on the wane as economic growth slows and the country shifts away from fossil fuels in order to curb pollution

- Closures would form part of the plan released earlier this month to shut as much as 500 million tonnes of surplus production capacity within the next three to five years

- China has a total of 10,760 mines, and 5,600 of them will eventually be required to close under a policy banning those with an annual output capacity of less than 90,000 tonnes

- China produced 3.7 million tonnes coal last year and has an estimated capacity surplus of 2 billion tonnes per annum

- China promised to stop approving all new coal mine projects for three years in a bid to control capacity

- BMI Research reported there will be an ongoing drive to consolidate the mining sector, with coal, bauxite, iron ore, nickel, lead and zinc expected to be among the minerals protected from excessive mining by heightened regulations in the future as part of China’s Five Year Plan

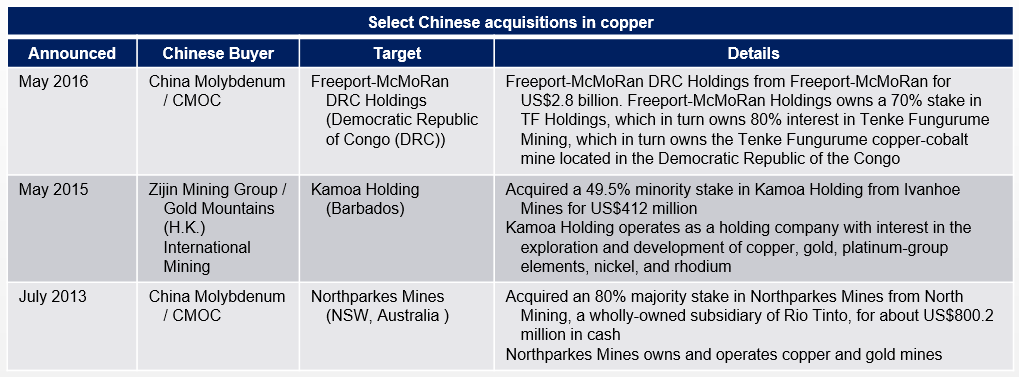

“China is very short of copper resources, the only way to make stable supply of copper resources . . . going overseas is the only solution” … “China’s copper consumption is akin to a “reverse pyramid” – Jerry Jiao, Vice-President of China Minmetals at the World Copper Conference in Santiago 2016

- Last December China’s state-owned Assets Supervision and Administration Commission said that Minmetals, which was founded in 1950, would merge with Metallurgical Corp of China, an infrastructure and construction group. That will allow the combined entity to control the whole metals value chain from mining to construction

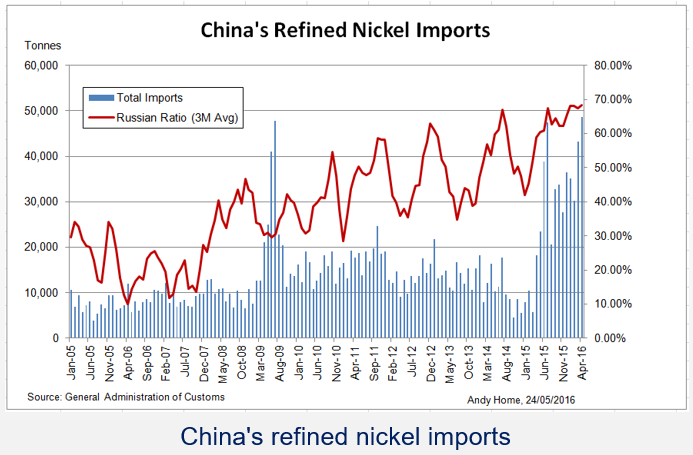

NICKEL

- Reuters reports that China is importing more nickel than ever before

- China alone now accounts for close to 52% of world nickel demand compared with 18% ten years earlier

- Imports of refined metal hit a new all-time record high of 49,012 tonnes in April 2016

- Cumulative tally of 157,600 tonnes over the first four months of the year represents a 115,000-tonne increase over the same period of last year

- Core driver of rising imports is the flow of Russian metal into China

- In April 2016 itself, Russian metal accounted for 80% of all imports

- A new product – nickel pig iron (NPI) – started to be produced in China in 2005 in different forms and grades

- Production increased slowly in the first few years but in 2010 production was estimated at over 160,000 tonnes and in 2015 at about 390,000 tonnes

- All of this product is used domestically in China in the production of stainless steel and has replaced traditional products like nickel metal and stainless steel scrap

IRON ORE

- China’s domestic iron ore production continued to fall during the first two months of 2016 with volumes down 6% year-on-year amid weak prices in a low season

“Only 30% of domestic mines were running in January, squeezed out of the market by low-priced imports… In Qian’an, a major iron ore hub in north China’s Hebei province, only three miners were operating, compared with more than fifty previously” – Chen Guanyin, analyst at Minerals & Jingyi Futures (2016)

- China imported 86.75 million tonnes of iron ore in May 2016, the fourth highest monthly figure on record and the biggest volume this year

- May cargos constituted a 22.4% rise from a year earlier

- Shipments climbed 9.1% to 412.15 million tonnes in the first five months of the year and at the current rate could reach the 1 billion tonnes per year mark in 2016 for the first time

- Iron ore imports have coincided with stockpiling with the country’s ports now stand at just over 100 million tonnes, up from 75 million tonnes during the summer months last year

- Largest importers to China include Australia, Brazil, South Africa, Ukraine and Iran

- China last year consumed two-thirds of the seaborne iron ore supply with imports reaching a record 968 million tonnes

“Accumulated steel output will exceed 10 billion tonnes this year, providing a huge reserve of scrap. Significant growth in obsolete scrap over the next decade is expected to lead to greater substitution for pig iron in the steelmaking process. Over time, this should result in a gradual decoupling of pig iron and crude steel production growth rates, translating to relatively lower demand for iron ore” – China’s Steel Industry Association CISA (mining.com)

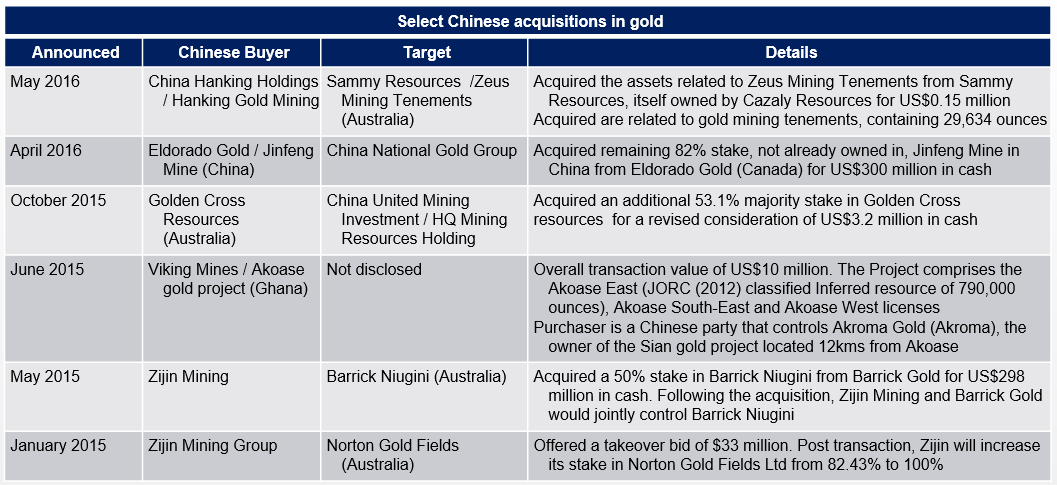

GOLD

- China consumes around 1,000 tonnes of gold annually versus its production of 490 tonnes of the metal

“China has five to six gold companies. I have been in touch with all of them, and they all have plans for increasing assets overseas,”…” Chinese companies are well-capitalized and better positioned than their North American counterparts.” – Peter Grosskopf, Chief Executive of Sprott (Toronto) a company that manages assets including physical bullion trusts

- Current push to reduce dependency on international producers

- Zijin Mining (China), considered the third largest gold producer, has been steadily shoring up offshore assets by acquiring stakes in Barrick Niugini and Norton gold Fields in 2015

- China Hanking, which is predominantly an iron ore and nickel operation, but is planning to aggressively acquire gold assets. The company is currently preparing for an initial public offering (IPO) for its gold projects in Australia

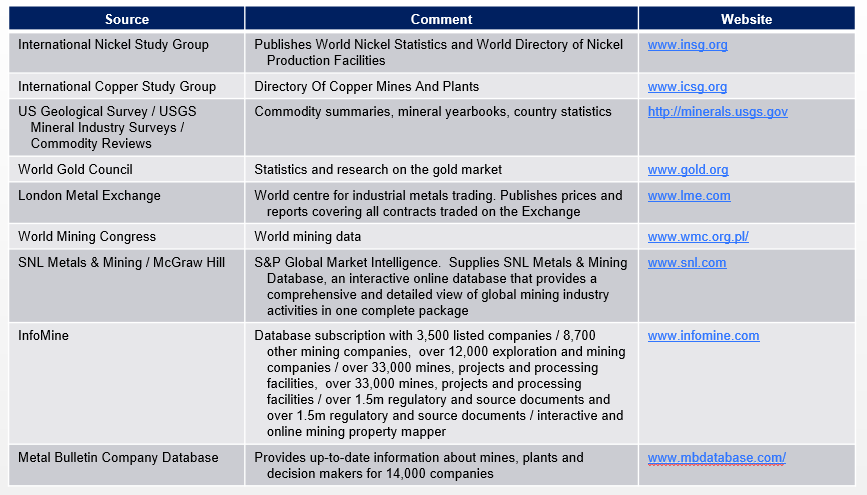

SELECT MINING INFORMATION SOURCES FOR STATISTICAL AND OTHER QUALITATIVE DATA

- Industry resources for statistical, directory, subscription or industry participant information in the mining industry include:

For More Information Click Here To Contact Us.